New era for the recycling industry?

The recycling industry has reached a turning point. On the one hand, progress has been made in improving recycling rates in recent years, while, on the other hand, the consumption of resources is rising to ever higher levels. In this report, we look at developments in the recycling of plastics, batteries and waste electrical and electronic equipment by leading companies. Is this already the dawn of a new era?

1 Introduction

The European Union (EU) is regarded worldwide as a pioneer in the recycling economy and recycling of recoverables from waste streams. In 2018, the EU amended its recycling goals for municipal waste and packaging. It decided on the binding goal of recycling 55 % of municipal waste EU-wide by 2025, and defined goals of 60 % to 65 % by 2030 and 2035. The landfill quota for municipal waste is to be limited to under 10 % by 2035. For the total quantity of packaging, by 2025 and 2030, recycling rates of 65 % and 70 %, respectively, are to be achieved, for plastics, recycling rates of 50 % (2025) and 55 % (2030) have been defined. To meet the increased requirements for the recycling of waste, especially the obligation for the separate collection of waste (specified waste types) has become much greater. This applies to batteries and waste electrical and electronic equipment.

2 Advanced plastics recycling

The recycling of plastics is currently based on mechanical processes, which is also referred to as material recycling. Here, the plastic waste is sorted by type, washed, melted and processed to recyclates. The problem is the more than one hundred types of plastic and material blends as well as the contamination of the plastics with all manner of impurities. This is the main reason that still only a small percentage of plastics is recycled, so plastics are predominantly incinerated instead (waste-to-energy recycling) or landfilled, and severely pollute landscapes and seas [1; 2; 3].

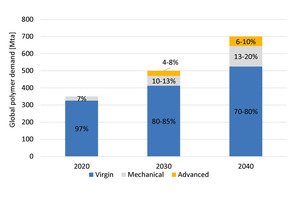

Advanced plastics recycling or just advanced recycling, ChemCycling or GreenCycling are intended to remedy this situation. In a study from 2022, McKinsey has looked at the potential for future recycling of plastics (Fig. 1). According to this, it is assumed that the consumption of polymers (the basic material for plastics) will roughly double from around 350 million tonnes per year (Mta) in 2020 to 500 Mta in 2030 and 700 Mta in 2040 [4]. Currently, the quantities that undergo advanced recycling are still negligible. By 2030, the advanced recycling rate is to grow already to 4 to 8 % of the polymer quantities, and then to 6 to 10 % by 2040. The percentages for mechanical recycling will increase in these years from 7 % to 13 to 20 %. For this, the advanced recycling quantities must increase to 20 to 40 Mta. The investments required to achieve this are estimated at US$ 40 bn up to 2030, while US$ 90 bn will be needed by 2040.

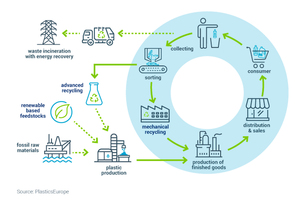

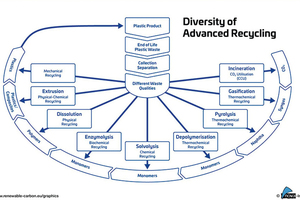

But what exactly does advanced recycling mean? The process concentrates on plastic waste that cannot be recycled mechanically for technological, economic or ecological reasons (Fig. 2). Examples are contaminated plastics, waste fractions consisting of different types of plastic that cannot be sorted further or recycled in some other way. Behind this term, there is a string of chemical, thermochemical, biochemical and physiochemical processes which can be used to break plastics down into their starting materials (Fig. 3). The most important processes are pyrolysis and gasification. In pyrolysis, plastic waste is broken down at high temperatures and with the exclusion of oxygen to produce pyrolysis oil. This product can be used in the production of new plastics as a substitute for fossil resources. A disadvantage so far are the high energy costs.

The chemicals enterprise Borealis is one of the leading companies in the recycling of polyolefins. In Lahnstein in Germany, Borealis started up one of the most advanced mechanical recycling plants for post-consumer polymer waste in 2021 (Fig. 4). This demonstration plant can recycle both films and solid plastic household waste. A high-grade recyclate is produced, which, thanks to its high purity, can be used in high-grade plastic applications, for example, in the automotive sector. In a collaborative project, Borealis, Neste, Uponor and Wastewise have succeeded in making pipes from cross-linked polyethylene (PEX) using a raw material recovered from chemically recycled post-industrial plastic waste by means of pyrolysis. The products are used in the construction industry for sanitary, heating, ventilation or air conditioning systems and even drinking water systems.

OMV, the Vienna-based oil, gas and chemicals enterprise, which now holds a 75 % stake in Borealis, had gained experience with its ReOil pyrolysis technology with a pilot plant at the Schwechat Refinery (Fig. 5). Now, by 2023, a demonstration plant is to be built for a capacity of 16 000 t/a. The input materials are supplied by local waste management contractors in Austria and consist of plastic waste which is made up mainly of polyolefins. OMV and Borealis are not the only companies pushing ahead with advanced recycling. In Europe, plants are under construction or in operation at BASF in Germany and at ExxonMobile in France. In the USA, companies like Alterra Energy, AmSty, Chevron Phillips Chemical, DOW Chemicals, Eastman Chemicals, Encina and LyondellBasell are also involved.

One of the US companies that supplies suitably sorted plastic waste that cannot be mechanically recycled otherwise is Nexus Circular. Supply contracts exist, for example, with Chevron Phillips and DOW for their pyrolysis plants. A somewhat different approach has been taken by WM (formerly Waste Management), the leading waste management company in the USA. In 2021, the company generated an annual turnover of US$ 17.9 bn 56 % of this turnover is generated by its collection business, 19 % by its landfill business, but so far only 8 % by recycling (Fig. 6). WM operates 254 waste landfills and has a fleet of 11 000 natural-gas-fuelled waste collection vehicles. According to its own reports, WM has the biggest waste recycling capacities in the USA. By 2026, around US$ 1 bn are to be invested in this sector, mainly in the increase in capacities and in automation of the sorting equipment for separating plastics.

3 The battery recycling business

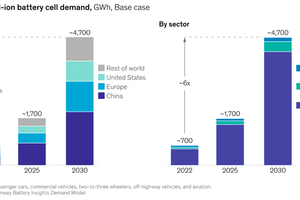

The market for electric cars is booming. In Germany, 18 % of new vehicles are fully electric, in UK the figure is 17 %, in France 14 %. In the USA, the percentage of new vehicles is only 6 %, in China, however, it has already reached 28 %. On account of the high energy and power density, mostly modern lithium-ion batteries are installed in electric cars. In cooperation with the Global Battery Alliance (GBA), McKinsey has released an update on the worldwide market demand for lithium batteries up to 2030 [5]. According to this, the market for lithium batteries will increase sixfold from around 700 GWh in 2022 with average annual growth rates of 27 % to around 4700 GWh (Fig. 7). Overall,120 to 150 new battery factories must be built worldwide. This will only be possible, however, if the recycling of raw materials from end-of-life (EoL) batteries is driven forward.

At the present time, China currently has around 50 % of the worldwide capacity of 0.25 to 0.3 Mta for the recycling of lithium batteries. The lithium-ion battery manufacturers there, CATL (Contemporary Amperex Technology Ltd.), Jingmen GEM and TAISEN Xunhuan, are currently the global market leaders [6]. This will presumably change crucially in the next few years. With new recycling plants that work on the basis of mechanical and hydrometallurgical processes, now almost the entire cobalt and nickel and up to 95 % of the lithium can be recovered from spent batteries. Aluminium, copper and graphite can also be recovered from the EoL batteries. The metal prices that can be achieved with the sale of the recycled materials can almost compete with those for virgin raw materials.

This has brought a large number of companies on the scene. In the USA and Canada, both Redwood Materials and Li-Cycle are planning gigantic battery recycling plants. For an investment of US$ 3.5 bn, Redwood is building a plant near Charleston, South Carolina (Fig. 8), which is scheduled to go into operation in 2024. From EoL lithium batteries, anodes and cathode components are recycled, finished and produced. Redwood, which was founded by the long-standing Tesla Technology boss Straubel, has concluded long-term supply contracts with Volkswagen USA, Ford Motors and Toyota, and, when operating at full capacity, it will deliver raw materials for 100 GWh storage capacity. The US Department of Energy has earmarked loans totalling US$ 2 bn to make the USA more independent of Asian manufacturers.

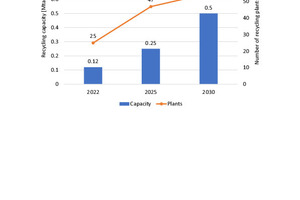

In Europe, the number of companies that want to get into the lucrative recycling market has also increased significantly. These include car manufacturers such as Volkswagen, Mercedes-Benz, BMW and Renault, mining and metallurgy companies like Glencore and Aurubis, chemical companies like BASF and Solvay, waste management and energy companies such as Veolia, Fortum and Endesa as well as recycling companies such as Accurec, Altilium Metals, BATREC, Duesenfeld, Ecobat, Eramet, Hydrovolt, REDUX Recycling, SungEel Hitech, TES and Umicore. By the end of 2022, in Europe, Li battery recycling capacities totalling 0.12 Mta had been installed (Fig. 9). By 2025, this number will grow to a good 0.2 Mta based on those projects either under construction or in planning. By 2030, a capacity of over 0.5 Mta is to be reached. The number of operative plants will increase from 25 in 2022 (including 9 pilot plants with output < 5000 t/a) to around 55 in 2025.

Volkswagen is building its own battery recycling plant at its Salzgitter site. To begin with, 1200 t material is to be processed there in a pilot plant. This quantity corresponds roughly to 3000 vehicle batteries. An increase in capacity is planned. In 2023, Mercedes Benz is starting up a recycling plant (Fig. 10) at its Kuppenheim site for initially 2500 t/a. The project is designed to set new standards in battery recycling with regard to ecological aspects. In China, through the BMW Brilliance Automotive (BBA) joint venture, BMW has also got a battery recycling plant off the ground. Back in 2021, Renault, Veolia and Solvay founded a consortium that takes the companies’ battery recycling to a new level and incorporates the existing activities of the three French companies. Specifically, this concerns Veolia’s battery recycling plants under construction in France and Great Britain.

At its Schwarzheide site in the Lausitz region, the chemicals giant BASF is building an industrial-scale plant for recycling black mass from EoL lithium batteries. The initial annual processing capacity is set to total 15 000 t battery material. The Finnish energy supplier Fortum already owns a recycling plant for 3000 t/a in Ikaalinen and is starting up a second facility in Harjavalta/Finland (Fig. 11) in 2023. Another Fortum plant is located in Kirchardt in Germany. Fortum has concluded a cooperation agreement on battery recycling together with BASF and Norilsk Nickel. Recycling specialists also have other interesting projects under construction or in planning. First and foremost is the Southern Korean SungEel Hitech, which already operates recycling plants in South Korea, Malaysia, China, India and Hungary with 11 GWh capacity. In Poland, another SungEel plant for 20 000 t/a is going on stream.

4 Recycling of Waste Electrical and Electronic Equipment

WEEE (Waste Electrical and Electronic Equipment) is currently the waste stream experiencing the highest increase worldwide. In 2019, WEEE totalled 53.6 Mta, 61.3 Mta are expected for 2023, and by 2030 already 74.7 Mta [7]. The average worldwide per-capita WEEE volume is 7.3 kg/person. Europe and America lead the field with 16.4 and 13.3 kg/person, while the level in Africa is 2.5 kg/person. In Europe, from the total volume of 12 Mta in 2019, around 5.1 Mta was collected for recycling, which corresponds to a recycling rate of 42.5 % (Fig. 12). In all other regions, the recycling rate is much lower, 9.4 % in America and just 0.9 % in Africa. Overall, it can be concluded from this that from the 53.6 Mta WEEE worldwide in 2019, only 9.3 Mta or 17.4 % were recycled, whereas 44.3 Mta or 82.6 % have gone down an unknown or non-documented route.

Nevertheless, a WEEE recycling industry has become established in recent years in Europe, North America, Japan and other developed countries in Asia. The most important industrial enterprises in the sector include Glencore, Mitsubishi Materials Corporation (MMC) and Aurubis, all of which operate metallurgy plants. Glencore International with a company headquarters in Switzerland has a worldwide network of recycling and metallurgy plants, in which, besides copper, nickel, lead and zinc, WEEE and battery materials are recycled. In the “Horne Smelter” near Quebec in Canada, up to 0.84 Mta scrap copper and WEEE can be smelted (Fig. 13) and processed to 99.1 % pure anode copper. This is probably the biggest facility of its type in the world. Besides the above-mentioned metals, Glencore also recovers the precious metals gold, silver, platinum and palladium from the WEEE.

Aurubis, headquartered in Hamburg, operates one of the world’s most sustainable integrated metallurgy networks. In the European metallurgy group, more than 1 Mta copper- and metal-containing recycling products are processed and new metals recovered from these. The focus is on copper, nickel, lead, tin, zinc, tellurium and precious metals. In addition to scrap copper, blister copper and various sludges, WEEE is the most important input product for recycling. To improve its position on the global markets, Aurubis is building a multi-metal recycling plant für € 300 mill. (Fig. 14) in Richmond, Georgia/USA. Commissioning is scheduled for the first half of 2024. The annual processing capacity for complex, metal-containing recycling material like WEEE will total 90 000 t/a. Aurubis is also planning a facility in Hamburg to get into the Li-ion battery recycling business.

The cost efficiency and size of the plants for the recycling of WEEE is a crucial criterion. This is clear from the example of the Mitsubishi Materials Corporation (MMC), which with its two Onahama and Naoshima smelting plants (Fig. 15) has been processing WEEE and specifically circuit boards to recover copper, gold, silver, palladium and other key metals since 2013 and 2016 respectively. The capacity of the Naoshima Smelter is currently 140 000 t/a, that corresponds to around 20 % of the global quantity of EoL circuit board material. By 2030, capacity is set to be increased to 200 000 t/a. MMC procures its circuit boards worldwide. 70 % come from over 60 countries. At the port of Moerdijk in the Netherlands, the company has set up a recycling plant for the collection and breakdown of circuit boards from Europe. The recycling material is then shipped to Japan.

5 Outlook

Functioning supply chains constitute a key problem and at the same time an economic challenge for the recycling of plastics, batteries and waste electrical and electronic equipment. This starts with the collection of materials. The Japanese MMC has, for example, developed an online platform for the acquisition of used circuit boards to safeguard the raw materials it requires for recycling. This problem is particularly drastic in the upcoming market for battery recycling. On the one hand, the recycling of lithium, cobalt and other rare metals is urgently necessary to enable the future growth of the battery capacities, on the other hand only relatively few electric vehicles are running up to now and, on the basis of a battery lifetime of 10 years, no large quantities will be available for recycling over the next few years.

It is not much different when it comes to the advanced recycling of plastics. As long as a large part of the plastics is sent to waste-to-energy recycling or is not collected and sorted at all, the quantities required for the cost-efficient operation of chemical plastics recycling plants are lacking. For this reason, it is important here to create the preconditions and install corresponding sorting capacities. For SMEs, there are therefore opportunities in conventional technologies like collection (return systems), sorting, mechanical comminution and processing of the waste. Every part of the value creation chain is justified and success here is only as good as the weakest link in this chain.

Literatur • Literature:

production, demand and waste data. 2020 Plastics Europe Association of Plastics Manufacturers, Brussels/Belgium

![12 Recycling rates for WEEE [7]](https://www.recovery-worldwide.com/imgs/1/9/2/9/1/4/1/tok_c1f3ee371d667ec53768b0e3ccd87d5f/w300_h200_x600_y430_12_Bild12L_WEEE_Flows-37d90531f7b892c4.jpeg)