Global trends in critical material recovery: 2025 and beyond

22.10.2025“Critical materials” might be a contender for mega-trend of the year, as tariff wars, export restrictions, and increased defense spending have thrust global strategic material supply into the headlines. Battery materials, rare earths, and semiconductors have emerged as critical materials in electric vehicles, green energy, AI, and computing applications. However, with critical material supply highly geographically localized and supply risks intensifying, the development of new critical material sources has become a key priority for both countries and businesses.

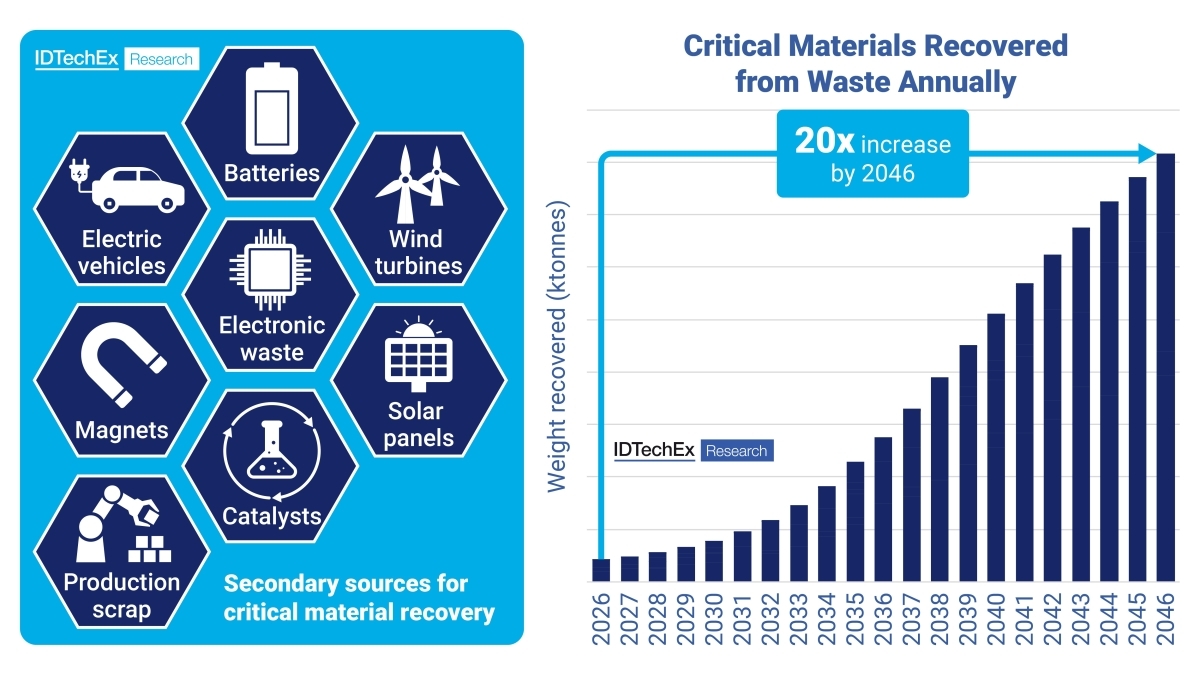

Critical material recovery from secondary sources presents growing market opportunities as critical materials are set to become increasingly available in waste streams. IDTechEx’s latest report, Critical Material Recovery 2026-2046:Technologies, Markets, Players , forecasts that 8,150 ktonnes of critical materials will be recovered from waste annually by 2046.

Secondary sources for critical material recovery and 20-year critical material recovery weight forecast

Secondary sources for critical material recovery and 20-year critical material recovery weight forecast

© IDTechEx

Critical materials on the rise

Critical materials are vital in diverse growth market applications, including electric transport, wind energy, green hydrogen, photovoltaics, data centers, and AI verticals. Lithium, nickel, cobalt, and graphite are critical materials for Li-ion batteries used in electric vehicles, while neodymium, terbium, and dysprosium are critical rare earths used in magnets for electric motors and wind turbine energy generators.

Critical semiconductors, including silicon, gallium, germanium, and indium, have applications in solar panels, optoelectronics, and integrated circuits. Growing demand in critical material market applications continues to drive the need for diversified supply.

The global supply of critical materials has come under increasing risk since 2024, with the high geographical localization of many strategic materials exposed by recent trade restrictions. In April 2025, China imposed export restrictions on critical rare earth magnet materials , following earlier rounds of restrictions on critical materials for defense applications and critical gallium and germanium semiconductors.

Governments and international organizations worldwide continue to define and grow critical material lists in line with domestic economic and national security priorities. Since 2024, New Zealand, Turkey, and NATO have all created critical material lists for the first time, while the UK and Australian government both expanded their lists.

Critical material recovery from waste

Critical material recovery from secondary sources and waste is a compelling option to diversify and secure critical material supply. Critical material containing waste is generated at the point of consumption, mitigating supply challenges. Critical materials are also typically present in higher concentrations in waste than in many primary mineral deposits, giving them greater value per weight. For example, recycled rare earth magnets can contain up to 33 % by weight of critical rare earths , whereas high-grade mineral deposits only contain up to 12 % by weight.

Another advantage of critical material recovery from waste is that mature extraction and recovery technologies pioneered in the mining sector are broadly applicable to critical material recycling. Pyrometallurgical (smelting) and hydrometallurgical (liquid extraction and separation) technologies are increasingly being leveraged to service both primary mineral and secondary recycled waste streams.

Active development areas focus on adapting pyro- and hydrometallurgical technologies to the unique and often complex composition of secondary feedstocks. IDTechEx’s latest research evaluates 15 emerging and future critical material recovery technologies, including ionic liquids, bio-metallurgy, solvent extraction, liquid chromatography and direct recycling, providing SWOT analysis and technology readiness evaluation for each.

As of 2025, critical material recycling rates are the greatest for critical base and platinum group metals. Global platinum group metal recovery regularly surpasses 20% of annual supply, driven by the high value of iridium, platinum, palladium and rhodium metals and consolidated applications in automotives, catalysts, and jewelry.

Recycling rates are markedly lower for critical rare earths, battery metals, and semiconductors, which are often used in inorganic compounds, alloys, and composite materials. For recycling rates to increase, greater waste availability, improved end-of-life recycling, and profitable business models for recyclers must emerge.

Growth opportunities for critical rare earth and battery material recovery

Li-ion battery recycling will be the largest critical material segment by value by 2046, which IDTechEx forecasts will grow at a CAGR of 15.9 % during this period. Mechanical and hydrometallurgical recycling capacity is growing across Asia-Pacific, Europe, and North America in anticipation of significant end-of-life electric vehicle stock becoming available for recycling by the mid-2030s. However, the battery recycling market remains in flux.

Emerging recycling regulations and policies in the US, EU, India, and China present strong tailwinds for critical battery material recovery; but downwards pressure on lithium, cobalt, and nickel cathode material prices will impact recycler profitability in the short-term.

Rare earth magnets will become key sources of secondary critical rare earths over the next decade, with recycling capacity increasing to service this growing feedstock stream. Valuable neodymium, praseodymium, dysprosium, and terbium can be recovered from high performance neodymium permanent magnets using long-loop and short-loop recycling methods.

IDTechEx finds that rare earth magnet production will grow 5.9x in the USA and 3.1x in Europe by 2036 , where swarf and manufacturing scrap will emerge as key feedstock of secondary rare earths for critical material recovery.

Manufacturing scrap continues to dominate critical rare earth and battery material recycler feedstocks in 2025, but this will shift over the next decade as the number of electric vehicles reaching end-of-life increases.

EVs will become a key source of secondary battery materials and rare earths recycled from Li-ion battery packs and electric motors, respectively. Electrification of global vehicle fleets will see the total value recovered by Li-ion battery recycling surpass that of the platinum group metals recycled from automotive catalytic converters by 2034, marking a significant turning point for the industry.

Critical material recovery beyond 2025

Critical material recovery from secondary sources and waste will be key to addressing critical material supply risks over the next two decades. Critical battery and rare earth recycling rates are expected to increase by 2046, driven by greater feedstock availability, increasing supply risks associated with materials, and a growing value opportunity for recovery.

A key challenge facing the future of critical material recovery and emerging circular supply chains will be recycled material prices and profitability. Critical material pricing will likely remain volatile, and periods of depressed commodity prices can kill recycling activity as it scales. IDTechEx predicts that strong supply chain partnerships, price-floor agreements, and gate fees will all play a role in supporting emerging critical material recovery markets

IDTechEx’s latest research report, Critical Material Recovery 2026-2046: Technologies, Markets, Players , provides comprehensive technology analysis, market research, key players, and 20-year granular market forecasts for Li-ion battery material recycling, rare earth recycling, critical semiconductor recovery, and platinum group metal recycling markets. This report includes 15 SWOT analyses, technology readiness evaluation and benchmarking, and supply chain analysis with over 45 company profiles.