High growth rates due to electromobility

As a result of the future prospects for electromobility, the market outlook for battery cells is extremely good. In a current market report, the well-known „World Economic Forum“ assumes that for the establishment of a sustainable value chain in global battery production the recycling capacities will have to be increased by a factor of 15 by 2030. This article discusses these assumptions and describes the battery recycling practice followed up to now. This information is rounded off by an overview of technological developments in the recycling of batteries.

1 Introduction

The automotive and commercial vehicle industry is facing major challenges and changes. Germany, for example, the automobile country par excellence, is aiming to achieve CO2 savings of 55 % by 2030 and 70 % by 2040 compared to the 1990 figures. To achieve this, the transport sector in particular, which has so far achieved only minimal savings, has to reduce its emissions by almost half in the next 10 years. Car manufacturers like Volkswagen, BMW and Mercedes will have to convert their vehicle fleets to electric motors and alternative power systems much faster and more extensively than previously thought. Electric mobility is the new future. The new Li-ion battery cells that are currently being developed for this purpose, will allow longer ranges and longer lifetimes at significantly lower prices.

In connection with the World Battery Alliance, the World Economic Forum (WEF) has published a vision for the establishment of a sustainable value chain by 2030 [1]. To comply with the Paris Agreement for reduction of the CO2-related temperature rises to below 2 °C, a circular economy for batteries can deliver 30 % of the savings required in the transport and energy sectors. By 2030, another 600 million inhabitants of the earth are to be given access to electricity, 10 million new jobs are to be created, 50 % of them in developing countries, and it is expected that the 35 % increase in battery consumption alone will generate US$ 150 billion. Battery manufacture will thereby develop into a key production sector, although it should not be forgotten that battery production also has a significant climate footprint.

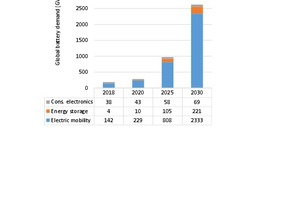

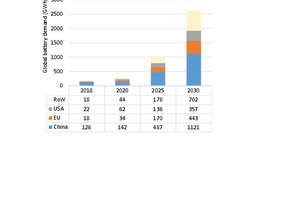

The first two figures show the visions presented by the WEF for the global battery demand from 2018 to 2030. The demand for batteries is forecast to increase by a factor of 14.3 from 184 GWh in 2018 to 2623 GWh in 2030. The battery applications are depicted in Fig. 1. Electromobility shows the greatest absolute growth, being forecast to increase from 142 to 2333 GWh. The largest forecast annual growth rate (CAGR) of 38 % is for energy-storage batteries, followed by electromobility with a CAGR of 26 %. In contrast, the anticipated growth in batteries for consumer electronics is relatively small at 5 %. Fig. 2 shows growth in the most important regions of the world. This forecasts the largest growth in the rest of the world (RoW) with 38 % CAGR, followed by the EU (29 %), USA (26 %) and China (20 %).

There are numerous other studies on the growth of electromobility and the growth rates of electrically powered vehicles and the types of batteries used. According to an analysis by the International Energy Agency (IEA), there were already 5.2 million electric vehicles in 2018, after 3.2 million in the previous year [2]. If the figures from the most important countries are totalled up, a study by the IEA indicates that in 2025 there will already be more than 55 million electric vehicles (two and three-wheelers, cars, minibuses, buses and trucks). In 2030 the number will have grown to 135 million vehicles, with 20 million new electric vehicles being registered in 2030 alone. In another scenario, which supposes that electric vehicles will make up 30 % of the global automobile production, the number of electric vehicles will roughly double.

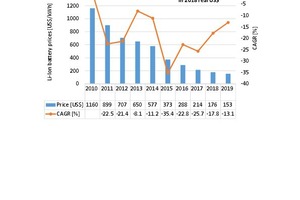

The price development of battery cells is of crucial importance. Fig. 3 shows the price trend for Li-ion batteries over recent years. This shows that since 2010 the price has drastically decreased from around US$ 1160/kWh to US$ 153/kWh. However, it should be borne in mind that battery power of around 75 kWh has to be installed in mid-range vehicles in order to achieve vehicle travel ranges of around 350 km. For 2019, this still corresponds to battery prices of just under US$ 11 500 for such vehicles. Large manufacturers such as Tesla have meanwhile announced an increase in installed capacity to 100 kWh and beyond in order to achieve greater ranges of over 400 km. The prices for these batteries are expected to drop below US$ 100 per kWh, and are later expected to even drop below US$ 80 per kWh.

2 Battery recycling statistics in Europe

2.1 Legal basis and battery types

In the EU, battery recycling is regulated by the EU Battery Directive 2006/66/EC (BattRL) of 2006. The aim of this directive is to reduce the environmental impact of used batteries and to recover and recycle them. In Germany, for example, the BattRL is implemented into national law via the Battery Act (BattG of 2009). The BattG applies to all types of battery (primary = not rechargeable and secondary = rechargeable) and thus includes so-called device batteries, vehicle batteries and industrial batteries (accumulators). Within the scope of product responsibility, the manufacturers and marketers (producers, importers and dealers) are legally obligated by the BattG to take back used batteries. Via the return systems, the different battery types are sorted and then recycled.

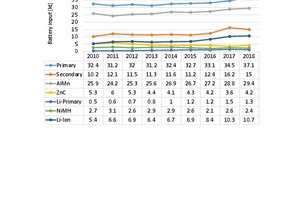

Fig. 4 shows the device batteries that have been on the market in Germany over the years and indicates the most important types of batteries. The figure shows that the number of device batteries increased from 42 531 t in 2010 to 52 159 t in 2018. Primary batteries most recently contributed 71 % of this amount, while secondary batteries accounted for 29 %. Alkaline-manganese cells, which are colloquially referred to as alkaline batteries, make up the majority of the device batteries, with 56 % [3]. Rechargeable Li-ion batteries meanwhile have a market share of over 20 % and also show the highest growth rates. Lithium primary batteries, on the other hand, have stagnated in recent years, and the same applies to zinc-carbon (ZnC) and nickel-metal hydride (NiMH) batteries.

2.2 Statistics for Europe

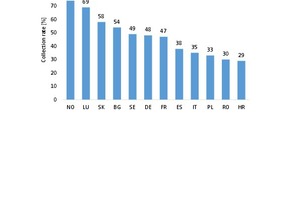

Fig. 5 depicts the collection rates for used batteries in some selected European countries in 2018. The EU average is 48 %, slightly exceeding the BattRL requirement of 45 % [4]. Norway and Luxembourg have the highest collection rates with over 74 % and 69 % respectively, followed by countries such as Germany, France and Sweden with 47 % to 49 %. Spain and Italy lag significantly behind with 38 % and 35 % respectively. In Eastern Europe, Slovakia and Bulgaria are in the lead with 58 % and 54 % respectively. Poland, Croatia and Romania, on the other hand, are at the bottom with collection rates of 35 %, 30 % and 29 %. Looking again at the figures for Germany, one can see that the collection rate for used device batteries has increased from 40 % in 2010 to 48 % in 2018. EU figures rose from 31 % to 48 % over the same period.

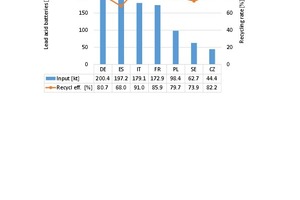

Fig. 6 depicts the recycling rates for lead acid batteries (lead storage batteries) that are generally used as starter batteries for motor vehicles. This figure shows that 1.388 million t of lead acid batteries came onto the EU market in 2018, after 1.063 million t in 2010. The most important national markets in the EU (excluding the UK) are Germany, Spain, Italy (2016 data), France, Poland, Sweden and the Czech Republic. These 7 countries already make up 70 % of the EU market. Of these countries, Italy leads the recycling rates for lead batteries with 91 %, followed by France with 85.9 %. Germany holds a mid-field position with a figure of 80.7 %, while Spain only achieves 68 %. In an analysis of all EU countries, the highest recycling rates are achieved in Hungary and Bulgaria with 99.3 % and 94.5 %, respectively. The lowest values aside from Spain are Slovakia (69.9 %) and Estonia (64.4 %).

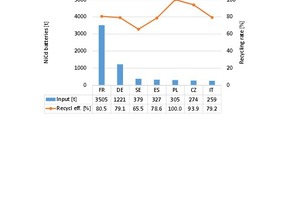

Fig. 7, analogous to Fig. 6, depicts the recycling rates for the nickel-cadmium batteries sold in the EU. After a quantity of 5000 t in 2010, around 7000 t still came onto the market in 2018. However, as no market data for 2018 is available for some countries, such as Italy and Spain, data from 2015 and 2016 were used in these cases. On this basis, these countries account for 90 % of the EU market. The largest markets are in France, Germany and Sweden, while the largest recycling rates are achieved in Poland (100 %) and the Czech Republic (93.9 %). Germany and France only manage midfield positions with 79.1 % and 80.5 % respectively. Belgium (68.1 %), Sweden (65.5 %) and Croatia (51.2 %) rank lowest.

3 Recovery processes and recycling companies

Depending on the type involved, batteries consist to a large extent of valuable materials such as zinc, lead, nickel, iron/steel, manganese and aluminum. They usually contain only small quantities of other substances such as lithium, cobalt, silver, rare earths, cadmium and mercury [5]. In Germany, the BattG law prohibits the marketing of batteries and accumulators with a mercury content of more than 0.0005 % by weight and a cadmium content of more than 0.002 % by weight. For used batteries with significantly higher cadmium and mercury contents, special recycling processes are required, which include, for instance, vacuum distillation. But even conventional batteries generally require special processes that provide selective recycling of the valuable materials. In every process, it is necessary for the used batteries to be type-sorted before recycling.

Today, the recycling rate for lead-acid batteries is almost 100 %. One of the leading companies in this sector is ECOBAT Technologies, who have a total of 13 melting furnaces on 3 continents. These collect an average of 120 million lead-acid batteries and recover over 800 000 t of lead every year (Fig. 8). But not only lead is recovered at a rate above 95 % in the recycling process; sulfuric acid and other substances are also recycled. ECOBAT is one of the world‘s largest lead producers. 75 % of the company‘s lead production comes from recycling. Berzelius Stollberg, a member of the ECOBAT Group, operates one of the world‘s largest and most modern lead works in Germany. Its annual capacity is 155 000 t, and it can produce over 100 different lead alloys. In addition, it produces 130 000 t of sulfuric acid.

The recycling rates of device batteries depend primarily on the collection rates, and secondly on the recycling processes used. At Umicore in Belgium, various types of device batteries are put into a melting process after prior sorting. Umicore specializes in the recycling of electronic waste and used batteries (Fig. 9). 17 different metals are recycled and refined in the company‘s Hoboken plant (Fig. 10). At an investment cost of € 100 million, the capacity of this plant has been increased by 40 % from 350 000 to 500 000 t/a. Li-ion batteries are melted down using an ultra-high temperature process (UHT). This section of the plant is designed for a capacity of 7000 t. This throughput corresponds to around 250 million mobile phone batteries, 200 000 batteries from hybrid vehicles (HEV) weighing around 35 kg each, or 35 000 batteries from electric cars weighing 200 kg each.

REDUX is one of the market leaders in primary device battery recycling. At its two German locations in Offenbach am Main and Bremerhaven, a total of up to 46 000 t of batteries can be processed each year. The company, which is a member of the Saubermacher Group, counts battery return systems from 20 different countries among its customers. In 2018, REDUX put a processing plant for Li-ion batteries into operation in Bremerhaven (Fig. 11). The plant has a capacity of 10 000 t/a and can process all types of Li-ion batteries. Using modern recycling technology, the plant can recover the maximum amount of valuable materials such as stainless steel, aluminum, copper, plastic and active masses from every battery. This means that 60 to 70 % of the materials in a battery can be recycled.

4 Developments in the recycling of

Li-ion batteries

In addition to Umicore and REDUX, numerous other companies around the world are already involved in the recycling of Li-ion batteries. The Chinese company CATL (Contemporary Amperex Technology Ltd) has become the market leader after taking over the recycling company Brunp. In 2018, CATL produced 21.3 GWh of lithium batteries, primarily for the electric vehicle (EV) market. The Chinese Jingmen GEM follows in second place with a current annual capacity of 50 000 t (Fig. 12). The company is investing an amount of RMB 3 billion (US$ 425 million) to build a new, even larger recycling factory for a capacity of 300 000 t. Another important Chinese company is TAISEN Xunhuan. Elsewhere in Asia there are large recycling capacities at Taisen Recycling and SungEel HiTech in South Korea and at 4R Energy in Japan.

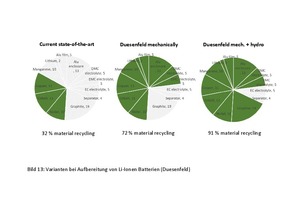

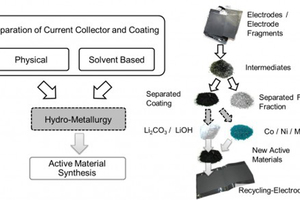

In the western world, in addition to the companies already mentioned, there are the recycling firms Retriev Technologies from the USA, Glencore and Li-Cycle from Canada, Eramet and RECUPYL from France, Accurec Recycling and Duesenfeld from Germany and the Swiss BATREC. There are also a number of research institutes that deal with the development of Li-ion battery technology and recycling, such as the iPAT (Institute for Particle Technology) at the TU Braunschweig (Brunswick Institute of Technology) or Fraunhofer IWS (Institute for Material and Beam Technology). The challenges at issue are illustrated in Fig. 13. In order to recycle large amounts of material from Li-ion batteries, the process of melting the batteries down and then extracting copper, cobalt and nickel is not sufficient. In order to achieve the highest possible recycling rates, the technological trend is towards combined mechanical-hydrometallurgical processing.

The company Duesenfeld GmbH, which is in principle a spin-off of the iPAT from Brunswick, has meanwhile built a modern plant with a capacity of 3000 t for the processing of Li-ion batteries. In 2019, this plant processed around 1000 t of batteries. For this purpose, the material is shredded under an inert gas atmosphere, thermally treated and subjected to various mechanical separation processes (Fig. 14). This makes it possible to separate valuable material fractions such as aluminum and copper foils. The remaining electrode coating, which is in the form of a „black powder“, is then further processed using hydrometallurgical methods in order to recover valuable metals such as lithium, cobalt, nickel and manganese. This process achieves a material recycling rate of at least 75 % [6]. Recovery of the electrolytes and of the graphite contained in the anode coating (Fig. 15) raises the recovery rate to over 90 %.

Since 2015, Accurec has been operating a recycling centre for Li-ion batteries in Krefeld/Germany. This plant has an annual capacity of 2000 t and uses the most modern processing technologies to achieve high recycling rates. Accurec is also involved in the EU-funded ECO2LIB project, which is under the leadership of the battery manufacturer VARTA. This project aims to produce and recycle Li-ion batteries in an ecologically compatible and economically profitable manner. The objective is to reduce the cost of the charging cycle of Li-ion batteries by 85 % while increasing their lifespan by 20 years and improving the recycling rate by 58 % compared to standard processes. These would surely be quantum leaps when you consider that just a few years ago recycling was not even considered to be economically feasible by various experts.

5 Market outlook

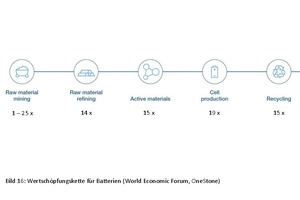

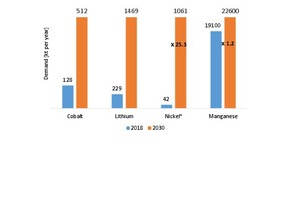

In order to achieve the battery capacities stated at the beginning of this article by 2030, considerable efforts are required in the entire value-added process (Fig. 16). The value creation chain starts with the mining of the important valuable minerals and also includes the smelting and production of the battery materials, the actual battery cell production and finally the recycling of the used batteries. By 2030, capacities for the recycling of battery materials as well as for their production will have to be increased 15-fold compared to today’s figures. Fig. 17 shows what this means in respect of the demand for the individual materials. The highest capacity increases will be required for lithium and nickel. The presented graph only includes nickel grades with purities greater than 99.8 % (class 1 nickel). In the case of cobalt and manganese, the additional required quantities are more readily manageable.

However, the manufacturers are striving to produce increasingly powerful Li-ion batteries. Today, the anode of a Li-ion battery generally consists of a copper conductor that is a few micrometers thick and is covered with a layer of graphite that is approximately 100 µm thick. Researchers at the IWS Fraunhofer Institute are aiming to replace this graphite layer with much thinner layers of silicon or lithium. These would then only have a thickness of around 20 or 30 µm. With such batteries, the energy density of 240 Wh/kg would be increased by almost 50 %. Other research groups are working on the assumption that the batteries of the future will no longer contain lithium or cobalt. In such batteries, solids will replace the previous liquid electrolytes. Solid electrolytes would reduce the risk of fire and allow quick charging and discharging while not requiring an external temperature control system.